ISi Insurance Underwriting Software

Transforming Complex Risk into Clear Decisions

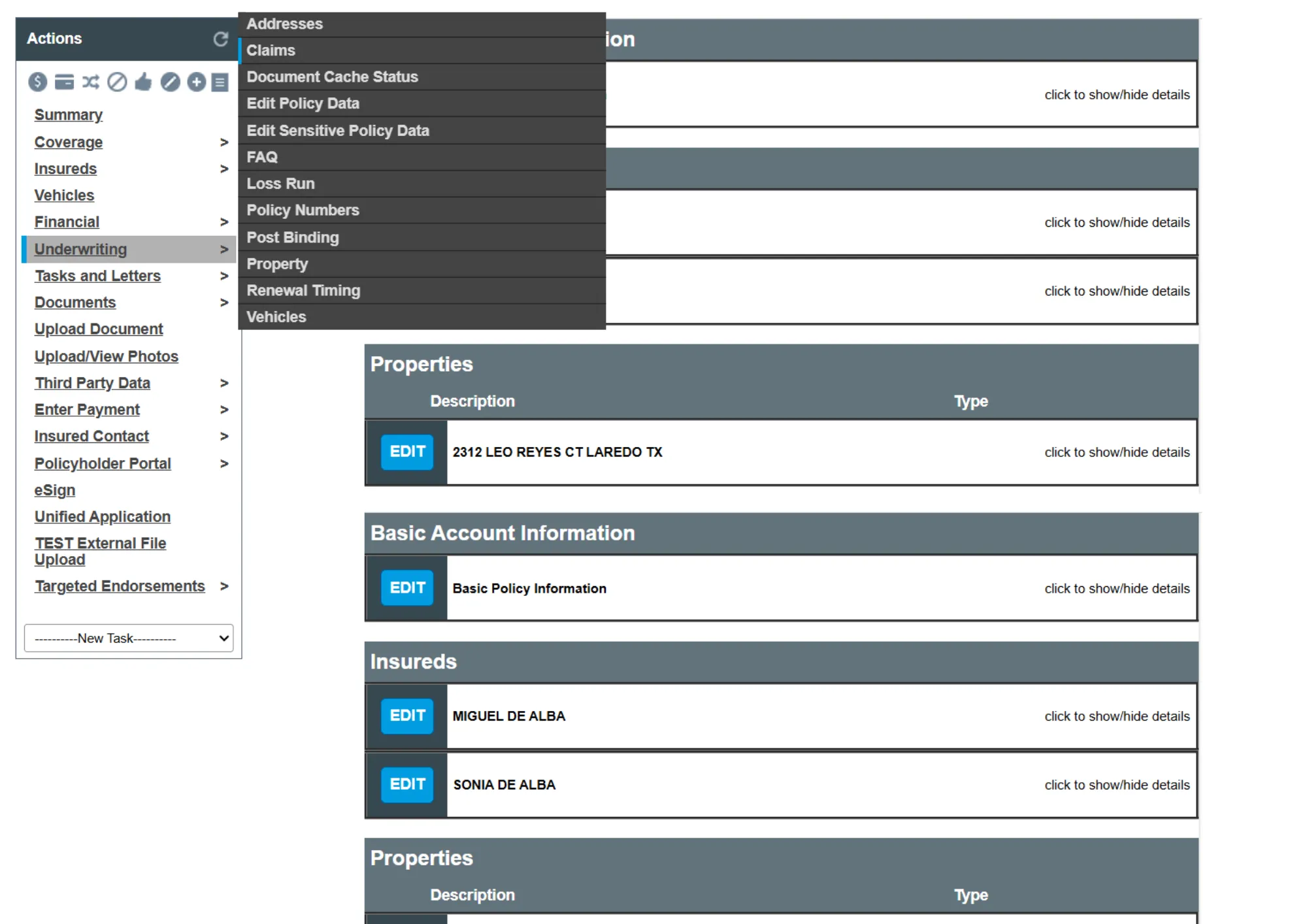

Risk evaluation, premium determination and defining policy terms and conditions are the foundation of ISi's underwriting software. Claims or policies can be smoothly transferred to an underwriter or adjuster for review and sent back to an agent.

A high level of customization goes into each company's application processes, including an evaluation of coverage eligibility based on client UW guidelines. Here are some more UW features ISi has to offer:

ISi Insurance Underwriting Platform Features

-

Address and claims management

-

Application processing

-

Automated or manual review

-

Automated renewal process

-

Claim loss history (TransUnion, Choice Point or IIX)

-

Coverage and endorsement management

-

Credit score (TransUnion, Choice Point or IIX)

-

Custom risk assessment and eligibility rules

-

Data capture and policy information management

-

Diary task-notes from insurance agents

-

Digital upload and validation

-

e-signatures

-

Ineligibility conditions and holds

-

Loss history analytics

-

New business, reinstatement and renewal counts

-

Notice of adverse underwriting decision

-

Optional rate flow display for transparency

-

Out-of-sequence endorsements

-

Policy inquiry and endorsement processing

-

Real-time rating (RTR)

-

Replacement cost calculator (AIR/ISO HomeValue)

-

Reporting

-

Special conditions or exclusions

-

Task notifications for UW review

-

Third-party reports (DMV, MVR etc.)

-

Track claim payments and reserves

-

Track loss adjustment expense (LAE) payments and reserves

-

Track written, earned and unearned premiums

-

VIN lookup (ISO VinMaster)